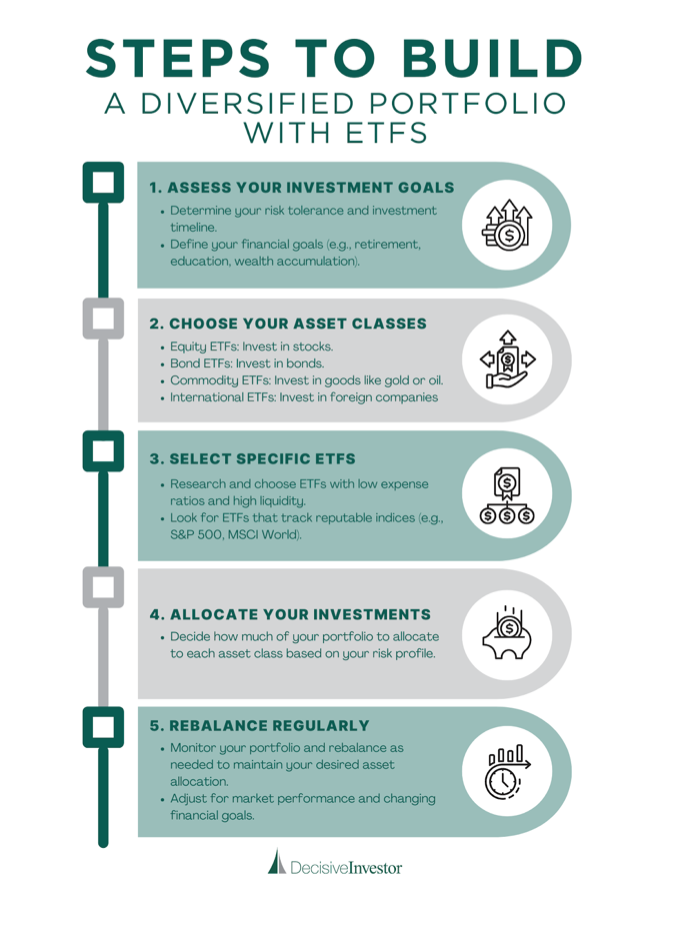

Investing in exchange-traded funds (ETFs) is a practical approach to building a diversified portfolio. ETFs offer access to a range of assets within a single investment. They can spread investments across sectors, regions, and asset classes, making them an appealing option for both new and seasoned investors in stock trading programs. Here’s a step-by-step guide on using ETFs to develop a balanced portfolio that aligns with one’s financial goals.

Assess Your Investment Goals

Before choosing ETFs, it is essential to define financial objectives and risk tolerance. Some investors want long-term growth, while others focus on income generation or capital preservation. Identifying these goals will help you select the right mix of ETFs. For instance, younger investors often seek growth-oriented ETFs that target stocks or sectors with high potential returns. On the other hand, investors nearing retirement may prefer lower-risk ETFs, such as those focused on bonds or dividend-paying stocks.

An assessment of investment goals can also influence one’s decisions when choosing stock trading programs and the necessary online trading software to manage and track investments. Tools that simplify the investment process, track performance, and allow easy rebalancing can be invaluable in staying on course with one’s goals.

Choose Your Asset Classes

Investopedia states, “An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. Equities (e.g., stocks), fixed income (e.g., bonds), cash and cash equivalents, real estate, commodities, and currencies are common examples of asset classes.”

Once goals are clear, the next step is to decide which asset classes will make up one’s portfolio. A diversified portfolio usually includes a mix of stocks, bonds, and possibly commodities or real estate. Each asset class has unique characteristics and risk factors. Stocks typically offer growth potential but come with higher volatility, while bonds provide income and stability. Commodities and real estate can add another layer of diversity, often moving independently from stocks and bonds.

Choosing asset classes helps one find the best ETF strategy. The best exchange-traded funds for diversification typically include a blend of stock and bond ETFs and sometimes ETFs focused on alternative assets.

3. Select Specific ETFs

After choosing asset classes, the next step is selecting specific ETFs. With thousands of ETFs on the market, investors should consider key factors such as expense ratios, performance history, and fund size. Additionally, ETFs with a strong performance history and substantial assets under management often provide a more reliable investment experience.

Using stock trading software can simplify comparing ETFs and selecting the right ones for a portfolio. Many programs and trading software solutions provide screening tools to filter ETFs based on asset class, cost, and historical returns. Online trading software platforms can also display ETF ratings and analyst reports, offering further insights to help investors make informed decisions.

Allocate Your Investments

Once the ETFs are chosen, the next step is determining how much to allocate to each. Asset allocation refers to dividing investments among the selected asset classes based on one’s goals and risk tolerance.

For a balanced approach, some investors consider a “60/40” portfolio, where 60% is invested in stock ETFs and 40% in bond ETFs. More experienced investors might include additional international stocks or real estate ETFs to add global diversification. Online trading software can be beneficial in this step, helping investors visualize their asset allocation and track portfolio weightings over time.

Setting an appropriate asset allocation helps limit risk and can improve returns. Diversifying among different ETFs reduces the impact of any one sector or market downturn on the portfolio, keeping it aligned with financial goals.

Rebalance Regularly

Over time, market performance can alter one’s initial allocation, potentially increasing the portfolio’s risk level. Rebalancing helps maintain the original allocation by buying or selling portions of ETFs to restore the desired asset mix. For example, if a stock ETF performs well, it may grow to represent a more significant portion of the portfolio, shifting the balance towards a riskier profile. Selling some of the stock ETF and buying a bond ETF can bring the portfolio back in line.

Regular rebalancing ensures that investments remain aligned with one’s objectives. Many of the best stock trading programs and trading software platforms offer automated rebalancing features, which make it easy to keep one’s portfolio balanced without manually tracking each position. Decisive Investor offers a range of resources and support options for investors interested in building a diversified portfolio with ETFs.

Holly Berry is a writer for Akomplice, a Marketing Company and Marketing Technology Agency located in Salt Lake City, Utah.

This article was fact-checked by Todd Noall. Todd Noall is an editor at Akomplice, a Marketing Technology Agency located in Salt Lake City, Utah.

Follow!